Trust funds are a vital tool in financial planning, providing a structured way to manage assets and ensure their distribution according to the wishes of the grantor. At their core, trust funds are legal arrangements where assets are held by a trustee for the benefit of one or more beneficiaries.

They serve various purposes, ranging from estate planning to charitable giving and providing for minors or individuals with special needs. Trust funds come in different forms, including revocable, irrevocable, and testamentary trusts, each with its own set of rules and benefits. Understanding how trust funds work is crucial for anyone considering establishing one to safeguard their assets and provide for their loved ones in the future.

We will delve into the intricacies of trust funds, exploring their types, key players involved, functioning, advantages, disadvantages, and common applications.

Table of Contents

Types of Trust Funds

Trust funds come in various forms, each tailored to specific needs and circumstances. Understanding the distinctions between these types is essential for selecting the most suitable option.

Revocable Trusts

Revocable trusts, also known as living trusts, allow the grantor to retain control over the assets during their lifetime. One of the primary advantages of revocable trusts is their flexibility.

The grantor can modify or dissolve the trust at any time, making it ideal for individuals who wish to retain control over their assets while planning for incapacity or death. However, because the grantor retains control, the assets in a revocable trust are still subject to estate taxes and creditors’ claims.

Irrevocable Trusts

Irrevocable trusts, in contrast, cannot be altered or revoked once established. Once the grantor transfers assets into an irrevocable trust, they no longer own or control those assets. This relinquishment of control offers certain benefits, such as asset protection from creditors and potential estate tax savings.

Assets placed in an irrevocable trust may be shielded from Medicaid eligibility calculations, making them valuable tools for long-term care planning. However, the trade-off for these benefits is the loss of control over the trust assets.

Testamentary Trusts

Testamentary trusts are created through a will and only take effect after the grantor’s death. Unlike revocable and irrevocable trusts, which are established during the grantor’s lifetime, testamentary trusts are activated upon the execution of the grantor’s will.

These trusts are commonly used to provide for minor children or individuals with special needs, as they allow the grantor to specify how and when assets should be distributed to beneficiaries. Testamentary trusts offer flexibility in estate planning, allowing the grantor to make adjustments to the trust provisions until their death.

Each type of trust fund serves distinct purposes and offers unique advantages and limitations. By understanding the characteristics of revocable, irrevocable, and testamentary trusts, individuals can make informed decisions when creating a trust to meet their financial planning goals.

Parties Involved in a Trust Fund

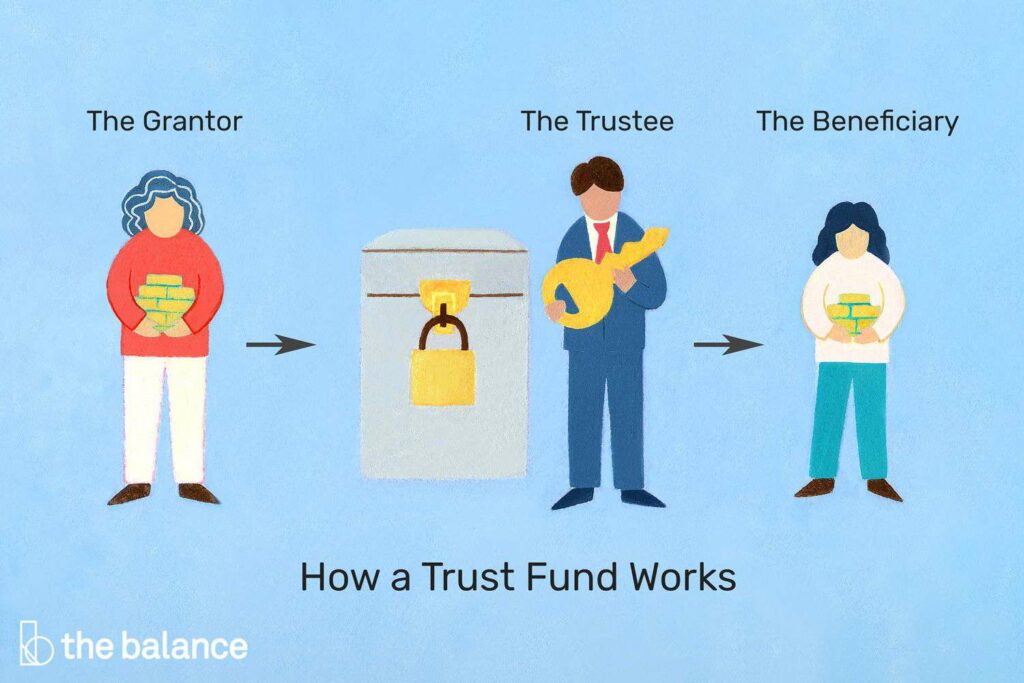

A trust fund involves several key parties, each with specific roles and responsibilities that contribute to its proper administration and operation.

Grantor/Settlor

The grantor, also known as the settlor, is the individual who establishes the trust fund and transfers assets into it. As the creator of the trust, the grantor determines the terms and conditions under which the trust operates, including how assets are to be managed and distributed.

It’s the grantor’s intent and instructions that guide the trustee’s actions in managing the trust. While the grantor may initially have control over the trust assets, this control may diminish or cease entirely depending on the type of trust established.

Trustee

The trustee is responsible for managing the trust assets and ensuring that the terms of the trust are carried out in accordance with the grantor’s instructions. This includes making investment decisions, distributing income or principal to beneficiaries, and maintaining accurate records of trust transactions.

The trustee has a fiduciary duty to act in the best interests of the beneficiaries and to administer the trust prudently and impartially. Depending on the complexity of the trust and the assets involved, the trustee may be an individual, a corporate entity, or a combination of both.

Beneficiary

The beneficiary is the individual or entity designated to receive benefits from the trust. Beneficiaries may include individuals, such as family members or loved ones, or charitable organizations. Depending on the terms of the trust, beneficiaries may be entitled to receive income generated by the trust assets, the principal itself, or both.

It’s essential for beneficiaries to understand their rights and entitlements under the trust, as well as any conditions or restrictions placed on distributions. Beneficiaries have the right to enforce the terms of the trust and hold the trustee accountable for fulfilling their duties.

A clear delineation of roles among the grantor, trustee, and beneficiary is crucial for the effective administration of a trust fund. Collaboration and communication among these parties ensure that the trust operates smoothly and achieves its intended objectives.

How Trust Funds Work

Understanding how trust funds function is essential for anyone considering establishing one. Trust funds operate through a series of steps, from creation to administration and distribution of assets to beneficiaries.

Creation of a Trust Fund

The process of creating a trust fund begins with the grantor, who establishes the trust and transfers assets into it. This typically involves drafting a trust agreement that outlines the terms and conditions under which the trust will operate.

The trust agreement specifies important details, such as the identity of the trustee, the beneficiaries, and how the trust assets are to be managed and distributed. Depending on the type of trust, the grantor may have varying degrees of control over the trust assets.

Funding the Trust

Once the trust is established, the grantor must transfer assets into the trust, a process known as funding. This can include various types of assets, such as cash, real estate, stocks, or other investments.

The grantor must formally transfer ownership of these assets to the trust, typically by changing titles or deeds to reflect the trust as the new owner. Proper funding ensures that the trust has assets available for management and distribution according to the terms of the trust agreement.

Administration of the Trust

Once funded, the trustee assumes responsibility for managing the trust assets and carrying out the grantor’s instructions. This involves making investment decisions, collecting income, paying expenses, and maintaining accurate records of trust transactions.

The trustee must act in the best interests of the beneficiaries and adhere to the terms of the trust agreement. Depending on the complexity of the trust and the assets involved, administration may require ongoing oversight and attention to ensure compliance with legal and fiduciary obligations.

Distribution of Assets to Beneficiaries

The ultimate purpose of a trust fund is to provide for the beneficiaries designated by the grantor. Depending on the terms of the trust, distributions may be made periodically, upon reaching specific milestones, or at the discretion of the trustee.

The trustee is responsible for determining the timing and amount of distributions and ensuring that they align with the grantor’s intentions and the needs of the beneficiaries. Effective communication between the trustee and beneficiaries is crucial to ensure that distributions are made in a timely and equitable manner.

Advantages of Trust Funds

Trust funds offer several benefits that make them valuable tools for estate planning and asset management.

Asset Protection

One of the primary advantages of trust funds is asset protection. Assets placed in a trust are typically shielded from creditors’ claims and legal judgments. This protection is particularly beneficial for individuals in professions with high liability risks or those concerned about potential lawsuits. Irrevocable trusts, in particular, provide strong asset protection as the grantor relinquishes ownership and control over the trust assets.

Estate Planning Benefits

Trust funds play a vital role in estate planning, allowing individuals to control the distribution of their assets after death. By establishing a trust, the grantor can specify how and when assets should be distributed to beneficiaries.

This can help minimize estate taxes, avoid probate, and ensure that assets are used in accordance with the grantor’s wishes. Revocable trusts offer flexibility during the grantor’s lifetime, while testamentary trusts provide a structured framework for distributing assets upon death.

Control Over Distribution

Trust funds provide the grantor with control over how assets are distributed to beneficiaries. This is especially important when beneficiaries are minors, individuals with special needs, or financially irresponsible.

The trust agreement allows the grantor to set specific conditions or restrictions on distributions, such as reaching a certain age or achieving certain milestones. By placing assets in trust funds, the grantor can ensure that beneficiaries receive financial support while also protecting their inheritance from mismanagement or squandering.

Trust Funds 101

Trust funds are powerful tools for estate planning and asset management, offering numerous advantages such as asset protection, estate tax savings, and control over asset distribution. Trust funds are valuable instruments for individuals seeking to protect their wealth, provide for their loved ones, and ensure the orderly transfer of assets across generations. It’s essential to weigh the pros and cons carefully and seek professional guidance to determine whether a trust fund is the right solution for your financial planning needs.

Have you had any experience with trust funds? Talk to us in the comments below!