To build lasting wealth, it’s important to track where your money goes each day and how it helps you achieve your long-term financial goals. Setting up a budget is one of the best ways to get started. While the idea of a budget might sound restrictive, it’s more of a tool for organizing spending and making sure every dollar has a purpose. One way to make budgeting easy is to get top free personal finance software to unlock your financial potential.

Managing personal finances can sometimes feel complicated, especially when balancing income, expenses, and savings. With financial tracking technologies like budgeting apps, though, it’s much easier to keep track. These tools help categorize spending, set savings goals, and monitor investments, making it possible to get a clear picture of financial health in one place.

In this article, you’ll find a rundown of top free personal finance software to unlock your financial potential, each offering different features for financial management.

Table of Contents

Benefits and Drawbacks of Budgeting Apps

Budgeting apps are a great way to manage money, stay on top of spending, and work toward paying off debt. With real-time financial tracking technologies, users can keep an eye on their budgets wherever they are. Many apps sync with bank accounts, automating the process and reducing the need for manual input. Some even make budgeting feel more engaging by turning it into a game, which can make the process less stressful.

Not having a budget can lead to financial problems down the line, especially if there’s no clear plan for managing money. However, budgeting apps aren’t for everyone. Some people might prefer using spreadsheets or other traditional methods to track their finances.

Pros

- Helps track progress on financial goals and reduce debt

- Organizes all finances in one place

- Sends reminders and sets limits to help control spending

- Some apps offer added features, like investment tracking and bill negotiations

- Provides insights into spending habits, helping to cut back in areas that need attention

Cons

- Privacy concerns in case of a data breach

- Subscription fees can pile up over time

- Might not work for those who prefer hands-on, manual budgeting

- Can be difficult for people with irregular income or unique financial situations

- Some apps provide too much information, which can be overwhelming

Main Features to Look for in the Top Free Personal Finance Software to Unlock Your Financial Potential

Choosing the top free personal finance software to unlock your financial potential can feel overwhelming with so many options available. To get the most out of an app, it’s important to look for certain features that can make managing money easier. Here are some things to consider when choosing an app:

Syncing

A great budgeting app should automatically sync with your bank accounts, credit cards, and other financial tools. This removes the hassle of entering transactions manually and keeps everything updated in real-time.

Goal Setting

If you’re working towards specific financial goals, like saving for a big purchase or paying off debt, an app that lets you set and track these goals is important. It helps stay motivated by showing progress and making it easier to adjust plans when needed.

Security

Security is a deal-breaker. A top-tier top free personal finance software to unlock your financial potential should offer strong protections, such as multifactor authentication and encryption, to keep your personal and financial information safe from potential threats.

Customization

The top free personal finance software to unlock your financial potential allows users to organize their finances in a way that fits their needs. Look for apps that let you customize spending categories, set preferences, and create a layout that works best for your financial situation.

Top Budgeting Apps

Finding the right budgeting app can make a huge difference in managing money. Here are some of the top free personal finance software to unlock your financial potential, each with unique features designed to suit different needs.

Quicken Simplifi

Quicken Simplifi offers an in-depth look at your finances, going beyond basic budgeting. This top free personal finance software to unlock your financial potential is great for monitoring investments, assets, and liabilities, providing a complete picture of your net worth. Some standout features include:

- Set clear targets for savings and track progress

- View anticipated balances over the next 30 days

- Create detailed reports based on specific categories or time frames

- Collaborate on budgeting with a partner

- Get a clear overview of all your accounts in one place

- Stay updated on your investments and potential refunds

While Simplifi’s budgeting and financial organizer features are useful, the app can be a bit clunky and harder to manage compared to other options like Mint. The budget menu is not as intuitive, requiring more steps to see specific transaction details.

There’s no free version or monthly billing option for Quicken Simplifi login, which could make the upfront cost feel like a risk for some users. Despite this, its all-around use of financial tracking technologies is beneficial for those who want a full view of their finances without zero-sum budgeting.

YNAB (You Need a Budget)

YNAB takes a goal-driven approach to budgeting. It uses a zero-based budgeting method, where every dollar is assigned to a specific category, ensuring complete accountability for all income. Features that stand out:

- Whether saving for an emergency fund or a vacation, YNAB helps track and manage progress toward your goals

- Offers strategies for paying off debt, including personalized recommendations

- Visual tools help you understand spending patterns and make informed decisions

YNAB is great for users focused on long-term goals, like paying off debt or saving for major expenses. It offers flexibility across devices and a free trial to help you decide if it fits your needs.

However, with a $109 annual subscription, it’s not the cheapest option. Moreover, the interface could also be more user-friendly, but the powerful tools for financial control make it a favorite among goal-setters.

PocketGuard

PocketGuard allows users to link external accounts, set up budgets, and track spending. One notable feature is its partnership with Billshark, which helps negotiate bills for a fee based on the savings it secures. Key features include:

- Automated savings (premium)

- Bill payment tracker (premium)

- Debt payoff planning

- Billshark bill negotiation

- Account sharing with a partner

The free version of PocketGuard is fairly limited, offering basic budgeting tools, expense tracking, and spending reports. The paid version opens up more features like automated savings and a debt payoff planner. However, there’s no free trial for the paid version, which can be a drawback for those unsure about committing to the monthly or yearly cost of $12.99 or $74.99.

For someone familiar with YNAB, PocketGuard’s layout feels familiar. The budget summary gives a quick snapshot of overspending and remaining funds. However, making adjustments can be frustrating. Editing category budgets involves multiple steps, such as selecting the category, accessing settings, and then editing.

Other apps allow changes directly from the main screen, making this extra navigation feel unnecessarily complicated. Similarly, editing transactions also requires several steps, which could be smoother.

Monarch

Monarch stands out for its flexibility, making it ideal for the self-employed. It lets users tag transactions as tax-related, helping them track deductions. The financial organizer app excels at managing income and expenses while providing a clear picture of current financial health and long-term growth. Key features include:

- Detailed setup tools

- Advanced transaction management

- Ability to carry over unused budget dollars

- Fast and intuitive user interface

- Unlimited collaborator access

While it is on the pricier side, Monarch justifies the cost with its comprehensive features, including thorough setup tools and an easy-to-navigate interface. If you want a quick overview or to look deep into your finances, Monarch’s design allows both.

Goodbudget

Goodbudget offers an easy-to-use digital envelope system for managing money, making it an excellent choice for those new to budgeting. As one of the best budgeting apps for couples, Goodbudget allows users to create a budget and categorize expenses without the need to connect a bank account.

Instead, transactions are entered manually, providing a hands-on approach to tracking spending. For couples, Goodbudget offers a shared experience, enabling partners to manage finances together and keep track of shared goals, like saving for a vacation or paying off debt. Top features include:

- Free version available with basic features

- Ideal for couples to track shared expenses and debts

- Digital envelopes help save for specific goals

- Educational resources to improve financial management

The free version gives access to 20 envelopes, while the paid option, at $10 per month or $80 per year, provides unlimited envelopes and additional features. This best budgeting app for couples also provides educational resources and money management courses to help users improve their financial literacy. Although Goodbudget doesn’t sync with bank accounts, it maintains security with bank-grade encryption, keeping your data safe.

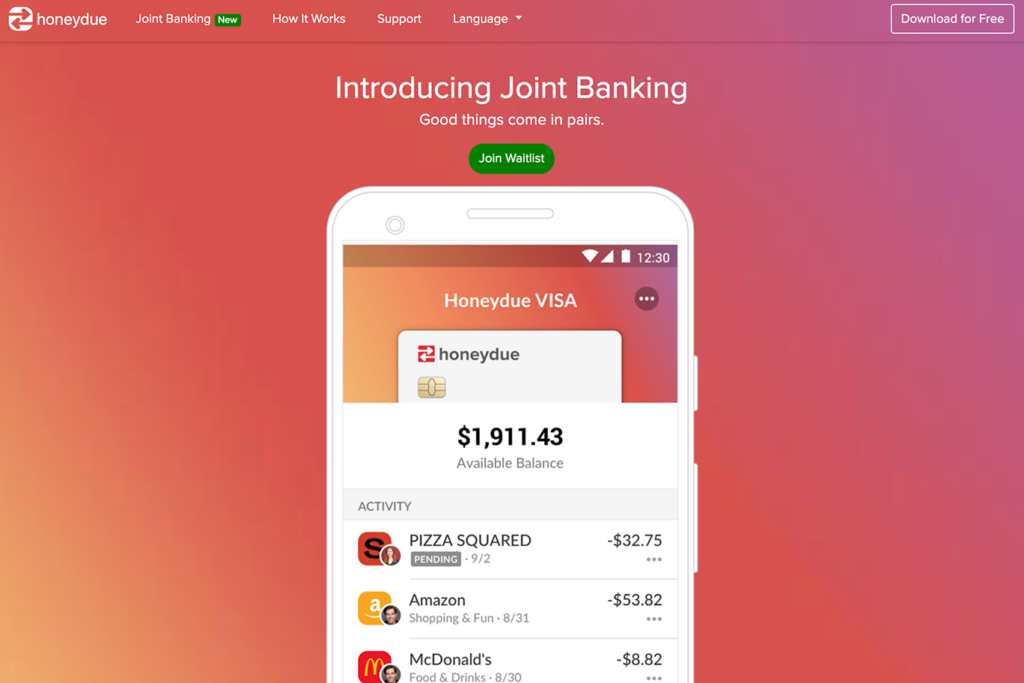

Honeydue

Image: idropnews

Honeydue is perfect for couples who want to manage their finances together. The app allows both partners to view and track bank accounts, credit cards, loans, and investments in one place. Partners can decide what to share with each other, offering flexibility and control over personal information.

The app automatically categorizes spending, and users can set monthly limits for each category. Alerts are sent when approaching those limits. Honeydue also sends reminders for bill payments and offers a chat feature, allowing couples to communicate about finances directly within the app.

It’s free to use and supports both iOS and Android devices, offering strong security features like data encryption and multi-factor authentication. Main features include:

- Free to use

- Syncs both partners’ accounts

- Customizable categories and spending limits

- Bill reminders and in-app messaging

- Provides a joint bank account option

Take Control of Your Financial Future!

Budgeting doesn’t have to be complicated. With the right financial organizer app, you can make smarter choices and stay on track to reach your goals. Whether you’re saving for something big or just trying to keep spending in check, choosing the right one from the list of top free personal finance software to unlock your financial potential can simplify the process. Experiment with a few options, find what works for you, and start building a better financial future today.

Whether you’re looking to optimize your personal budget or build a strong online presence for your business, the right tools make all the difference. At EvolveDash, we specialize in creating custom digital solutions that help businesses thrive. From developing user-friendly mobile apps to crafting tailored websites, we’re here to turn your vision into reality.

With a proven track record of helping over 100 satisfied customers and 450 completed projects, we’re confident we can help you achieve your goals too. Ready to make 2025 the year you take charge of your finances? Let’s make it happen together!

FAQs

Can budgeting apps help with tax preparation?

Some budgeting apps, like Monarch, offer features that help track tax-related expenses and deductions. They allow you to tag transactions, making it easier to prepare for tax season. However, not all apps provide this functionality, so be sure to check before relying on them for tax management.

Are there any completely free budgeting apps?

Yes, apps like Goodbudget offer free versions with basic features, such as creating a budget and tracking spending. However, even the top free personal finance software to unlock your financial potential have limitations, such as a restricted number of envelopes or fewer customization options.

Can I use multiple budgeting apps at the same time?

Yes, you can use multiple budgeting apps to manage different aspects of your finances. For example, you might use one app for tracking spending and another for monitoring investments. Just keep in mind that syncing multiple apps might require extra time and effort.

Can budgeting apps help me improve my credit score?

Some budgeting apps offer insights into your spending habits, which can help you manage debt and improve your credit score. However, apps like YNAB may not directly affect your credit score, but they can help you reduce debt, which positively impacts your credit.

Are budgeting apps available for both Android and iOS?

Most top budgeting apps, including YNAB and PocketGuard are available on both Android and iOS platforms, ensuring access no matter which device you use.

What happens if a budgeting app goes down or experiences technical issues?

Most budgeting apps back up your data in the cloud, so your information should remain secure even if the app faces technical issues. However, it’s important to check whether the app offers support or an offline mode in case of outages.

Do I need to link my bank accounts to a budgeting app?

No, many apps like Goodbudget allow you to manually enter transactions, so you don’t have to link your bank accounts. However, syncing with your bank accounts can automate tracking and reduce manual entry.