A “finfluencer,” or personal finance influencer, is a social media personality who specializes in sharing tips about finances and money. They establish credibility in a specific industry or niche and use social media to promote themselves. They build a devoted audience and following by sharing content through social media channels such as TikTok, YouTube, Instagram, and Facebook, and they usually have websites and blogs.

Table of Contents

Financial Influencers: Everything You Need to Know

The rise of the personal finance influencer can be partly attributed to the growing use of social media to access money advice. For example, here’s where Gen Z and millennial investors look for money tips, according to Morning Consult:

- Facebook—33%

- Instagram—32%

- Reddit—29%

- X platform (formerly Twitter)—27%

Personal finance influencers can earn money by sharing their financial knowledge in several ways, including by monetizing a YouTube channel, sharing sponsored posts, and selling digital products or courses. They also dabble in affiliate marketing, but the Federal Trade Commission (FTC) requires social media influencers and affiliate marketers to disclose affiliate relationships or sponsorships in which they may be paid to recommend a specific brand or product.

Not all personal finance influencers provide high-quality content. When you are choosing a personal finance influencer to follow, you’ll want to ensure they are reputable and trustworthy. It’s important to vet the influencers giving you financial advice. You can check whether a financial influencer has specific certifications that make them more qualified to provide financial advice—for example, a Certified Financial Planner (CFP) has been through a rigorous process and is certified by a well-known institution. Look for red flags that a financial influencer may have ulterior motives besides helping you with your finances. For example, they may give advice that sounds very risky or promise to make you rich quickly.

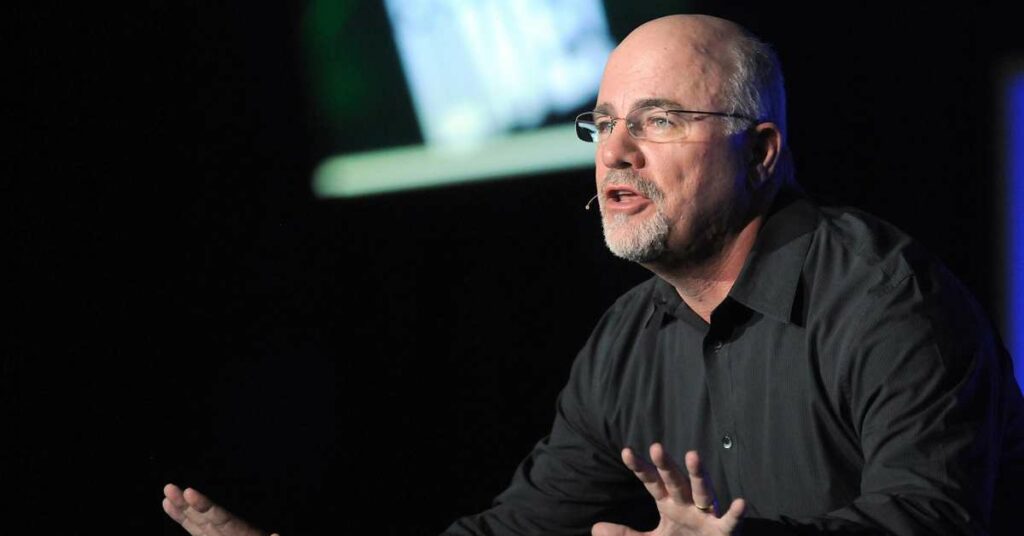

Dave Ramsey

Dave Ramsey has become a household name in personal finance with his straightforward approach to money management. His tips on debt reduction have helped millions of people take control of their finances. He advocates for living debt-free, building an emergency fund, and investing wisely for the future. You probably know him from his hit podcast, where he gives quick advice to live callers, ‘The Ramsey Show.”

However, his magnum opus has to be his “Baby Steps” program. It provides a clear roadmap for financial success, starting with no knowledge of financial management whatsoever. It makes his advice accessible to people at all stages of their financial journey. People who want practical tips on budgeting and getting out of debt should check out Dave Ramsey.

Suze Orman

Suze Orman is a financial expert and bestselling author known for her no-nonsense approach to money matters. Orman’s advice covers a wide range of topics, from retirement planning to investment strategies. Just the fact that she has over 25 million books in circulation should let you know she’s the real deal. Some of her best sellers include:

1) The Ultimate Retirement Guide for 50+,

2) Women and Money: Be Strong, Be Smart, Be Secure,

3) Suze Orman’s 9 Steps to Financial Freedom,

4) The Laws of Money, The Lessons of Life

She emphasizes the importance of financial education and empowerment, encouraging individuals to take control of their own finances. Orman’s insights into personal finance are backed by years of experience and expertise, making her a trusted source of information for millions of followers. Follow Suze Orman for valuable advice on achieving financial security and peace of mind.

The Budget Mom (Kumiko Love)

Kumiko Love, also known as The Budget Mom, is a certified financial education instructor who shares practical budgeting tips and tools to help individuals manage their money. Love’s advice is anchored in simplicity and empowerment, making it accessible to everyone, regardless of their financial situation.

Don’t be fooled by the boomer name, though; she’s savvy with technology. You can find her on most social media channels, in her blog, and in her popular budgeting printables. Love inspires her followers to take control of their finances and live a life free from financial stress. Follow The Budget Mom for creative budgeting solutions, motivational content, and personalized financial guidance.

Graham Stephan

Graham Stephan is a real estate investor, YouTuber, and personal finance guru known for his savvy investment strategies and practical money advice. Stephan’s YouTube channel offers a wealth of content on topics such as real estate investing, saving money, and achieving financial independence.

He shares his own experiences and insights into building wealth, making his advice relatable and actionable for his audience. Stephan’s transparent approach to finance has earned him a dedicated following of aspiring investors and money-savvy individuals. Follow Graham Stephan for valuable tips on building wealth through real estate, smart investing, and financial independence.

Patrice Washington

Patrice Washington is a financial empowerment coach, author, and speaker dedicated to helping people break out of the wild goose chase of a high net worth. She’s a huge advocate of finding your real purpose in life rather than placing your self-worth on your salary. Washington’s approach to financial education goes beyond budgeting and saving to address the underlying mindset and behaviors that impact financial success.

She encourages her followers to identify their values, set meaningful goals, and take intentional action to create the life they desire. Through her books, podcasts, Huffington Post articles, and online courses, Washington provides practical tools and strategies for building wealth and living a fulfilling life.

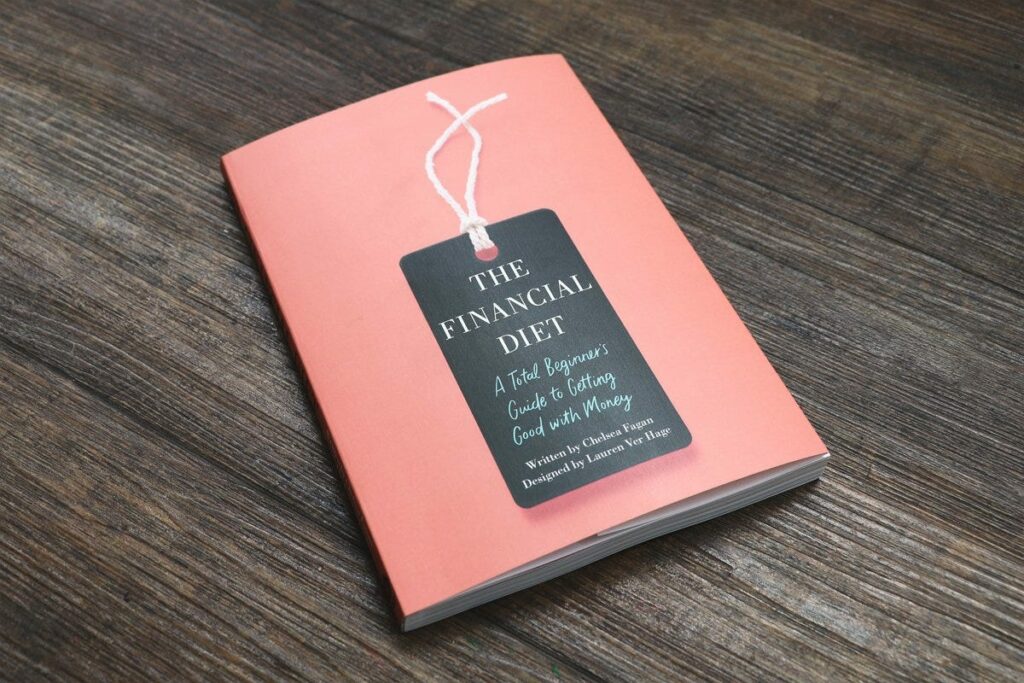

The Financial Diet

The Financial Diet is a platform dedicated to helping people navigate the complexities of personal finance in a fast-paced western economy. Founded by Chelsea Fagan and Lauren Ver Hage, The Financial Diet offers a diverse range of content on topics such as budgeting, investing, career development, and lifestyle choices. However, as you probably judged from their name, their biggest focus is on tackling the epidemic of overspending and ruining credit.

Their approach to finance emphasizes the importance of financial literacy, mindfulness, and self-care. Through articles, videos, and podcasts, The Financial Diet provides practical tips, expert insights, and relatable stories to help readers and listeners build a secure financial future. Follow The Financial Diet for valuable advice on managing money, advancing your career, and living a financially balanced life.

Michelle Schroeder-Gardner

Michelle Schroeder-Gardner is a personal finance blogger, entrepreneur, and digital nomad known for her transparent approach to online business. Schroeder-Gardner’s blog, Making Sense of Cents, chronicles her journey from debt to financial independence and offers practical advice on topics such as earning extra income, saving money, and paying off debt.

She shares her own experiences, successes, and challenges, making her advice relatable and approachable for her audience. She also offers online courses and resources to help others achieve their financial goals and live life on their own terms.

Tony Robbins

Tony Robbins is a bestselling author, motivational speaker, and life coach known for his dynamic presence and empowering messages. While Robbins is not exclusively focused on personal finance, his insights into wealth creation and a success mindset are invaluable for anyone seeking financial freedom. He emphasizes the importance of clarity, focus, and persistence in achieving your goals, whether they are financial, personal, or professional. Through his books, seminars, and online courses, Robbins provides practical strategies and tools for mastering your finances and creating a life of abundance. Follow Tony Robbins for powerful insights, motivational content, and actionable steps to transform your financial future.

Farnoosh Torabi

Farnoosh Torabi is a financial expert, author, and host of the “So Money” podcast, where she interviews top business leaders, entrepreneurs, and financial experts about money and life. Torabi’s approach is grounded in authenticity, empathy, and practicality. Her viewers believe that’s what makes her a trusted source of information and inspiration.

She covers a wide range of topics, from entrepreneurship and investing to navigating financial challenges and achieving financial independence. Torabi’s expertise, combined with her engaging storytelling style, makes her podcast a must-listen for anyone seeking valuable insights and actionable advice on money matters.

The Minimalists

Joshua Fields Millburn and Ryan Nicodemus, known as The Minimalists, are advocates of minimalism and intentional living. While not traditional financial influencers, their philosophy aligns closely with the principles of financial independence, frugality, and mindful consumption. The Minimalists encourage their followers to prioritize experiences over possessions, live within their means, and focus on what truly matters in life. Through their books, podcasts, and documentary films, Millburn and Nicodemus share their own journey toward minimalism and offer practical advice on decluttering, simplifying, and finding fulfillment without excessive materialism. Follow The Minimalists for thought-provoking content, practical tips, and inspiration to live a simpler, more intentional life.

These financial influencers offer valuable insights, practical advice, and inspiration to help you achieve your financial goals and build a secure future. Whether you’re looking to get out of debt, start investing, or simply improve your money management skills, these guides can provide you with the knowledge and motivation you need to succeed.

For more similar blogs, visit EvolveDash today!

FAQs

- What qualifications should I look for in a financial influencer?

Look for certifications like Certified Financial Planner (CFP), as they indicate credible financial advice backed by formal training and experience.

- How do financial influencers make money?

They earn through sponsored posts, affiliate marketing, selling digital products, or monetizing platforms like YouTube.

- Are all financial influencers trustworthy?

Not all influencers provide reliable content. Vet them by checking for certifications and avoiding those who promise unrealistic gains.

- Can I trust financial advice from influencers on platforms like TikTok or Instagram?

Many influencers share useful tips, but be cautious. Always cross-check advice with trusted resources before making financial decisions.

- How do I know if a financial influencer’s advice is suitable for my situation?

Personal financial advice should cater to your unique needs. Make sure the influencer’s advice aligns with your financial goals and lifestyle.