Starting a business often brings one big question: how to fund it? It’s a challenge that every entrepreneur must face early on. Many people have ideas, but turning those ideas into reality requires more than just creativity. It takes action and, most importantly, money.

Finding the right funding is very important. It’s the first big hurdle that needs to be tackled. Understanding where to get funding and knowing the available options can make a significant difference.

This article breaks down ten of the best ways to fund a startup. Each method offers something unique, whether it’s about finding the right investor, using personal savings, or exploring alternative financing methods. By exploring these options, it’s possible to find the right path to bring a business idea to life. So, let’s explore.

Table of Contents

VC Funding

VC funding involves a venture capital firm providing money in exchange for equity. This type of funding is popular among startups, especially those aiming for rapid growth. It’s because the amounts involved are often larger than other options.

Having support from a reputable VC firm can significantly enhance a startup’s credibility, particularly in a competitive environment where securing capital is challenging. Once a well-known VC shows interest, others often follow due to fear of missing out.

The focus of VCs when reviewing a pitch deck varies depending on the startup’s stage:

In the pre-seed stage, VCs prioritize the startup’s vision over revenue or product-market fit. The team’s reputation and commitment are important. Investors are likely to assess the founders’ backgrounds more than their early financials. Some level of market validation for the product is also expected.

During the seed stage, a clear explanation of the problem and the startup’s solution is needed. Investors evaluate the founder’s ability to tackle the challenge and look for evidence of early traction. A product demo can also be convincing.

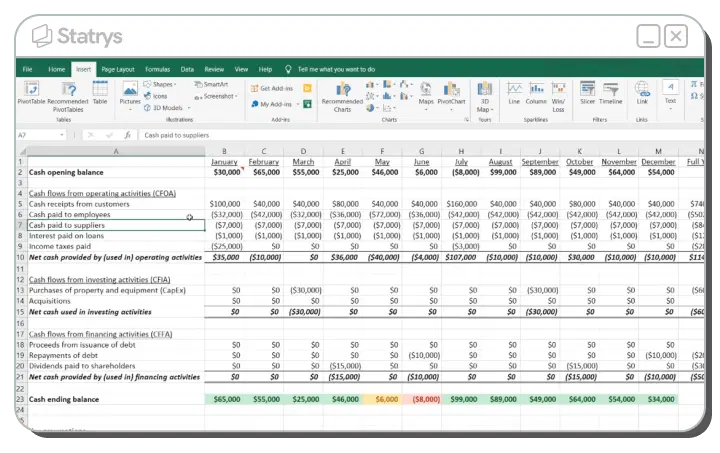

At Series A, the focus shifts to numbers. Metrics and financial models become significantly more detailed at this stage. Investors need to see sales figures, an income statement, or a cash flow forecast for at least three years. Despite the emphasis on metrics, the strengths and experience of the founding team remain important.

In Series B, investors look for a large market and a product that stands out. Having a well-built team is crucial at this point, as key hires should have already been made. The ability to show predictable growth and efficient use of capital is also critical at this stage.

Crowdfunding

Crowdfunding is a method of raising money where many individuals contribute small amounts through an online platform. There are different types of crowdfunding:

In equity crowdfunding, supporters gain a stake in the company. Businesses often secure the majority of their funding from a lead investor before turning to the public for additional contributions.

Rewards-based crowdfunding offers non-financial perks to backers. These perks could include early access to the product or exclusive merchandise. This approach is useful for gathering feedback in the product’s early stages.

Crowdlending allows startups to borrow money through peer-to-peer lending platforms. These loans come with interest and must be repaid by a set deadline. For startups unsure of their ability to repay on time, this can be risky, especially if the loan is secured by assets.

There is a lot of emphasis on the importance of clear communication in crowdfunding. The audience is diverse, with varying levels of investment knowledge. So, how the company presents itself and the opportunity is crucial.

There is also a need for high-quality content to attract investors. After securing funds, keeping backers informed is essential. Regular updates on the company’s progress help maintain ongoing support.

Invoice Factoring

Invoice factoring is becoming a widely used method for funding businesses, especially in many countries. This involves selling unpaid invoices to a factoring company.

It’s an effective way to boost cash flow and raise funds for growth. Additionally, it reduces the burden of managing collections since the factoring company takes over that responsibility.

Here’s how the process works:

First, submit your invoice details to a factoring company, also known as a “factor.” The company reviews your sales ledger to assess your eligibility. After evaluating the risks, they provide a quote. Once the agreement is signed, the factoring process begins.

The process itself is straightforward. After invoicing your customer, the factoring company advances 80–90% of the invoice value to your business, usually within 24 hours. When your customer pays the factor and the payment is processed, the remaining amount is released to your business, minus a small fee.

This method is gaining popularity because it’s not considered a loan, so there’s no debt to repay. It’s especially helpful for businesses dealing with slow-paying customers or long payment terms. Instead of waiting weeks or months for payment, the majority of the invoice value is received within hours. No collateral is required, apart from the accounts receivable, and a good credit score isn’t necessary. As long as customers are creditworthy, qualifying for factoring is likely.

Angel Investors

Angel investors are usually wealthy individuals who invest in startups. The amounts can range from a few thousand to up to a million dollars.

These investors are an important source of early-stage funding and are often easier for entrepreneurs to access. They play a vital role in the equity fundraising process.

One of the biggest advantages of working with an angel investor is their ability to make decisions independently. Since they don’t have to navigate through a corporate hierarchy, they can invest based on their own judgment. This flexibility can be especially valuable for startups in their early stages.

Angels often have expertise in specific fields, usually areas where they have been successful before. This benefits entrepreneurs in several ways. First, they don’t ask uninformed questions, as they already understand the industry. Second, their connections in the industry can bring additional resources to help the startup grow.

Despite the name, angel investors aren’t there to rescue businesses in trouble or offer charity investments. They invest with the goal of earning a strong return. Their motivation is financial, and they expect to profit from their investment.

Angel investors often join forces to form networks. These networks allow angels to share deals, opportunities, and resources. For entrepreneurs, these networks provide a way to reach many potential investors at once. Even if the network doesn’t invest as a group, an individual angel within the network might take an interest.

Product Presale

Selling products before they are officially launched is a simple way to raise funds. This method works best when a business is centered on a specific product.

However, it’s important to make sure that the product’s quality is high before offering it for presale. Customers who are not satisfied might request refunds or share negative feedback. So, it’s important to meet their expectations.

Using this method can be stressful, as it involves managing pre-orders to secure funding. It’s wise to carefully consider the potential pressure this approach can bring.

One benefit of pre-selling is that it ensures production is aligned with demand, helping avoid excess inventory. It also keeps the business on track with deadlines since customers expect timely delivery of the promised products.

SBA Loans

An SBA loan is a type of financing supported by the Small Business Administration (SBA), a federal agency founded in 1953. The SBA assists small business owners by providing mentorship, workshops, and loans.

These loans are guaranteed by the SBA but are not directly issued by them. To get an SBA loan, a local lender that offers these loans must be contacted. The SBA’s backing can help small businesses access loans they might not otherwise qualify for.

Bootstrapping

Bootstrapping means funding a startup using personal savings and the business’s revenue, without outside investment.

This method works well for early-stage startups. However, some factors must be considered. Startups in capital-heavy industries or those still finding their market fit might struggle with bootstrapping. They may benefit more from venture capital.

Bootstrapping lets founders keep full control over their decisions. Yet, it also means missing out on the advice and support investors can provide. Without this expert guidance, managing the startup can be more challenging, especially for those new to the process.

Entering Contests

Many businesses can benefit from entering competitions organized by corporations. These contests are designed to help small and medium-sized business owners find great ideas. Creativity and careful planning are keys to success. Winners can receive awards, funding, and valuable business advice.

These competitions often focus on early-stage businesses in specific industries. To enter, having a solid business plan or an innovative product is crucial. It’s important to clearly define the problem being solved.

To stand out, the project needs to be unique and engaging. Judges and investors will closely examine the business idea, so it must be impressive enough to capture their interest and secure their votes.

Even if the competition is not won, there is a chance to attract investors. They may find the idea appealing, even if it doesn’t win the contest.

Grants

Grants provide funding from governments, foundations, or corporations to support business growth. Unlike loans or investments, grants don’t need to be repaid or require giving away equity.

Each year, numerous grants are available for small businesses. These often focus on supporting minority entrepreneurs, funding research, developing specific industries, promoting women-owned businesses, or rewarding innovation.

Finding the right grant requires thorough research. Each grant has different criteria. Providers generally look for businesses that align with their goals and can effectively use the funds.

To improve the chances of receiving a grant, first understand the grant provider’s objectives and what the grant aims to achieve. Next, prepare a comprehensive and professional business plan. Tailor the application to show how the business will help meet the grant’s goals. Apply early to avoid last-minute rushes and explore other similar grants from various organizations or government bodies.

Accelerators

Accelerators are programs designed for early-stage startups. They offer mentoring and support to help founders develop their businesses. This can be especially valuable for first-time entrepreneurs who lack connections in the industry. Many accelerators provide a cash boost upon completion but usually require giving up a small portion of equity, often around 10%.

However, not all accelerators are equally effective. Venture capitalists often consider only a few programs, such as Entrepreneur First and Y Combinator, as particularly valuable. While mentorship is a key feature, its effectiveness can vary. According to feedback from some participants, 71% felt their accelerator was unhelpful because the mentors lacked the right experience to provide meaningful guidance.

Understanding a business’s needs and assessing each funding option helps make smart choices. It’s important to match the funding method with the startup’s goals and stage of development. Careful consideration and thorough preparation can greatly boost the chances of a successful launch and growth.

Ready to turn your startup idea into reality? Explore various funding options and choose the one that aligns best with your business goals. Start planning today and set your business on the path to growth! Visit our website for more information.

FAQs

- How do I choose between venture capital and bootstrapping?

Choosing between venture capital and bootstrapping depends on factors like the startup’s growth goals, industry, and personal preferences. Venture capital can provide large amounts of funding and valuable guidance but requires giving up equity. Bootstrapping allows for complete control but can be slower and more challenging without external funding.

- What should I consider before entering a business contest?

Before entering a business contest, ensure that your business idea is well-developed and aligns with the contest’s focus. Research the contest’s judges and previous winners to understand what they value. Prepare a compelling pitch and be ready to showcase how your idea stands out.

- What are the risks associated with crowdfunding?

Crowdfunding risks include not reaching the funding goal, receiving negative feedback, or failing to deliver on promises. There can also be legal and financial implications if the campaign does not meet its obligations or if the product or service doesn’t meet backers’ expectations.

- How do accelerators differ from incubators?

Accelerators and incubators both support startups but in different ways. Accelerators provide intensive, time-limited programs with mentorship and funding, typically in exchange for equity. Incubators offer longer-term support and resources to help startups grow at their own pace, often without requiring equity.